Jet Ski dealers across Australia are overstocked in the lead-up to winter – which has triggered massive discounts across all three major brands Sea-Doo, Yamaha WaveRunner and Kawasaki Jet Ski.

Industry data sourced by Watercraft Zone shows sales of Jet Skis in Australia hit reverse in 2023 – down by a staggering 24 per cent after record deliveries in 2022 (a year in which the total market almost hit 10,000 sales across all brands nationally).

The massive sales slowdown means all three brands – Sea-Doo, Yamaha WaveRunner and Kawasaki Jet Ski – have too much stock and are starting to do sharp deals to clear showrooms ahead of the winter off-season.

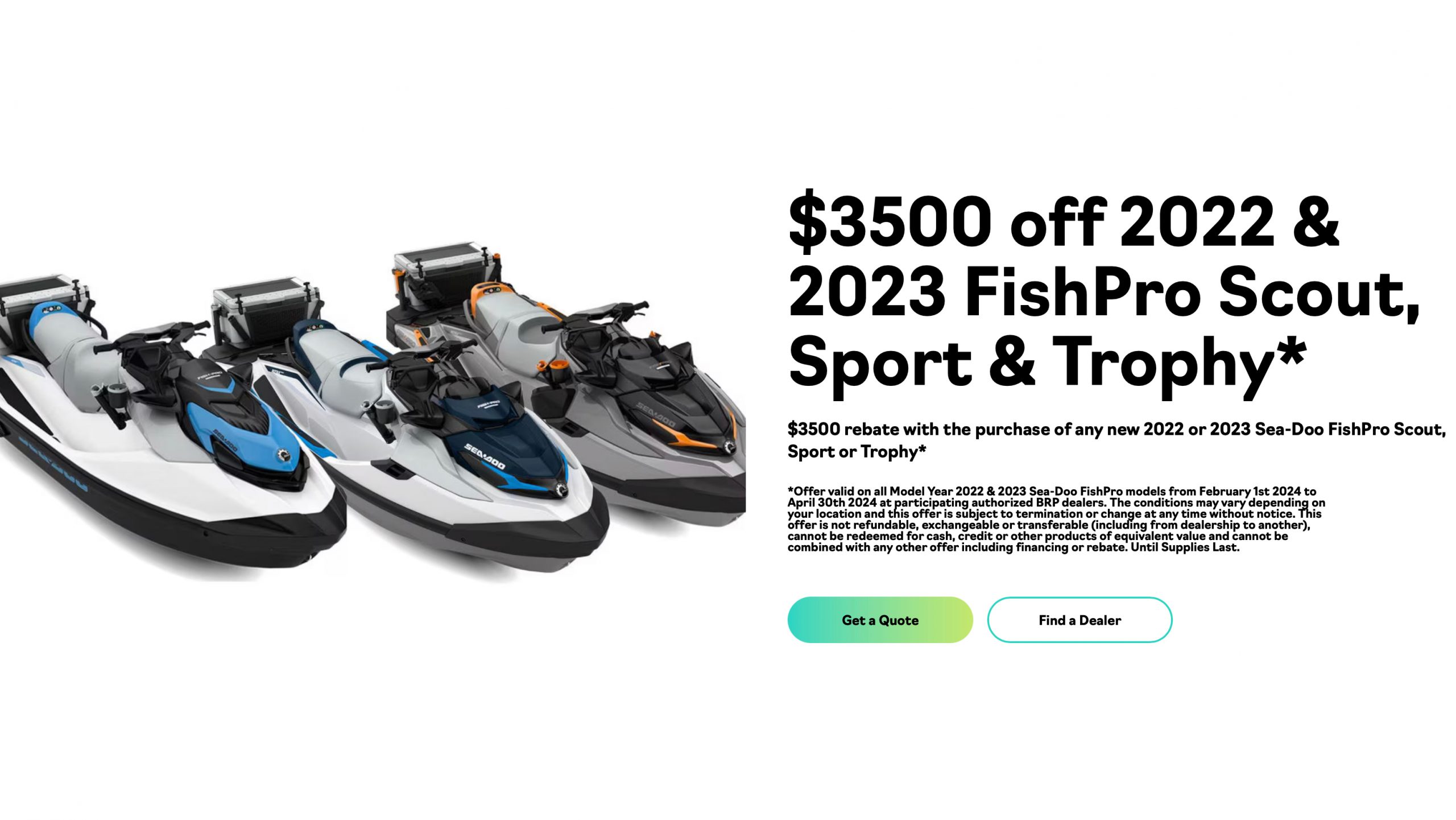

As this article was published Sea-Doo had longstanding offers of up to $3500 off certain models until the end of April 2024.

Kawasaki originally had up to $2000 off certain models until the end of April 2024, but it has just extended the offer to run to the end of May 2024.

And Yamaha WaveRunner has just launched a six-week sales promotion of up to $2000 off certain models until the end of May 2024.

Industry insiders have started to speculate whether Sea-Doo, Yamaha, and Kawasaki Jet Ski discounts will be extended yet again amid the current sales slump.

Although next summer is half a year way, the three major Jet Ski brands are already planning ahead to make sure they clear 2023 and 2024 stock before 2025 models start to arrive later this year.

The sales data provides an interesting insight into how each Jet Ski brand is enduring the current cost-of-living crisis.

Sea-Doo is still the market leader by a significant margin in Australia.

Sea-Doo represented 75 per cent – or three out of every four new Jet Skis – sold last year, compared to Yamaha WaveRunner (21 per cent) and Kawasaki Jet Ski (4 per cent).

While the 2023 figures show Sea-Doo sales have returned to a stable pre-COVID level, deliveries of Yamaha WaveRunners and Kawasaki Jet Skis fell to below pre-COVID levels.

Sea-Doo, Yamaha WaveRunner and Kawasaki Jet Ski market share:

- 2023: Sea-Doo (75 per cent), Yamaha (21 per cent), Kawasaki (4 per cent)

- 2022: Sea-Doo (77 per cent), Yamaha (19 per cent), Kawasaki (4 per cent)

- 2021: Sea-Doo (77 per cent), Yamaha (17 per cent), Kawasaki (6 per cent)

- 2020: Sea-Doo (68 per cent), Yamaha (26 per cent), Kawasaki (6 per cent)

- 2019: Sea-Doo (69 per cent), Yamaha (26 per cent), Kawasaki (5 per cent)

- 2018: Sea-Doo (70 per cent), Yamaha (23 per cent), Kawasaki (7 per cent)

Sea-Doo, Yamaha WaveRunner and Kawasaki Jet Ski sales:

| Year | Sea-Doo Australia | Yamaha WaveRunner Australia | Kawasaki Jet Ski Australia | Total Australian market |

| 2023 | 5655, down 26 per cent vs prior year | 1600, down 17 per cent vs prior year | 250, down 24 per cent vs prior year | 7505, down 24 per cent vs prior year |

| 2022 | 7660, up 43 per cent vs prior year | 1925, up 59 per cent vs prior year | 330, down 20 per cent vs prior year | 9915, up 42 per cent vs prior year |

| 2021 | 5345, down 5 per cent vs prior year | 1210, down 44 per cent vs prior year | 415, down 25 per cent vs prior year | 6970, down 16.7 per cent vs prior year |

| 2020 | 5650, up 11 per cent vs prior year | 2165, up 13 per cent vs prior year | 550, up 49 per cent vs prior year | 8365, up 13.7 per cent vs prior year |

| 2019 | 5070, up 8 per cent vs prior year | 1920, up 25 per cent vs prior year | 390, down 24 per cent vs prior year | 7380, up 9.7 per cent vs prior year |

| 2018 | 4695 | 1530 | 485 | 6710 |

Above: Sales of personal watercraft in Australia, and the percentage change from the prior year. Figures have been rounded.

MORE: All our Sea-Doo coverage in one click

MORE: All our Yamaha WaveRunner coverage in one click

MORE: All our Kawasaki Jet Ski coverage in one click

MORE: All our news coverage in one click

MORE: Follow us on Facebook

MORE: Follow us on YouTube